99

EC World Real Estate Investment Trust ANNUAL REPORT 2016

NOTES TO THE

Financial Statements

For the Financial Year ended 31 December 2016

16. Investments in subsidiaries (continued)

Acquisitions of subsidiaries

On 25 August 2015, the Group acquired 100% of equity interest in Hangzhou Chongxian Port Investment Co.,

Ltd., Hangzhou Chongxian Port Logistics Co., Ltd., Hangzhou Bei Gang Logistics Co., Ltd., and Hangzhou Fu Zhuo

Industrial Co., Ltd. for considerations of RMB956,500,000 (equivalent to S$209,760,000).

On 9 September 2015, the Group acquired 100% of equity interest in Hangzhou Fu Heng Warehouse Co., Ltd. for

consideration of RMB168,900,000 (equivalent to S$37,462,000).

On 6 November 2015, the Group acquired 100% of equity interest in Zhejiang Hengde Sangpu Logistics Co., Ltd.

for consideration of RMB250,000,000 (equivalent to S$55,375,000).

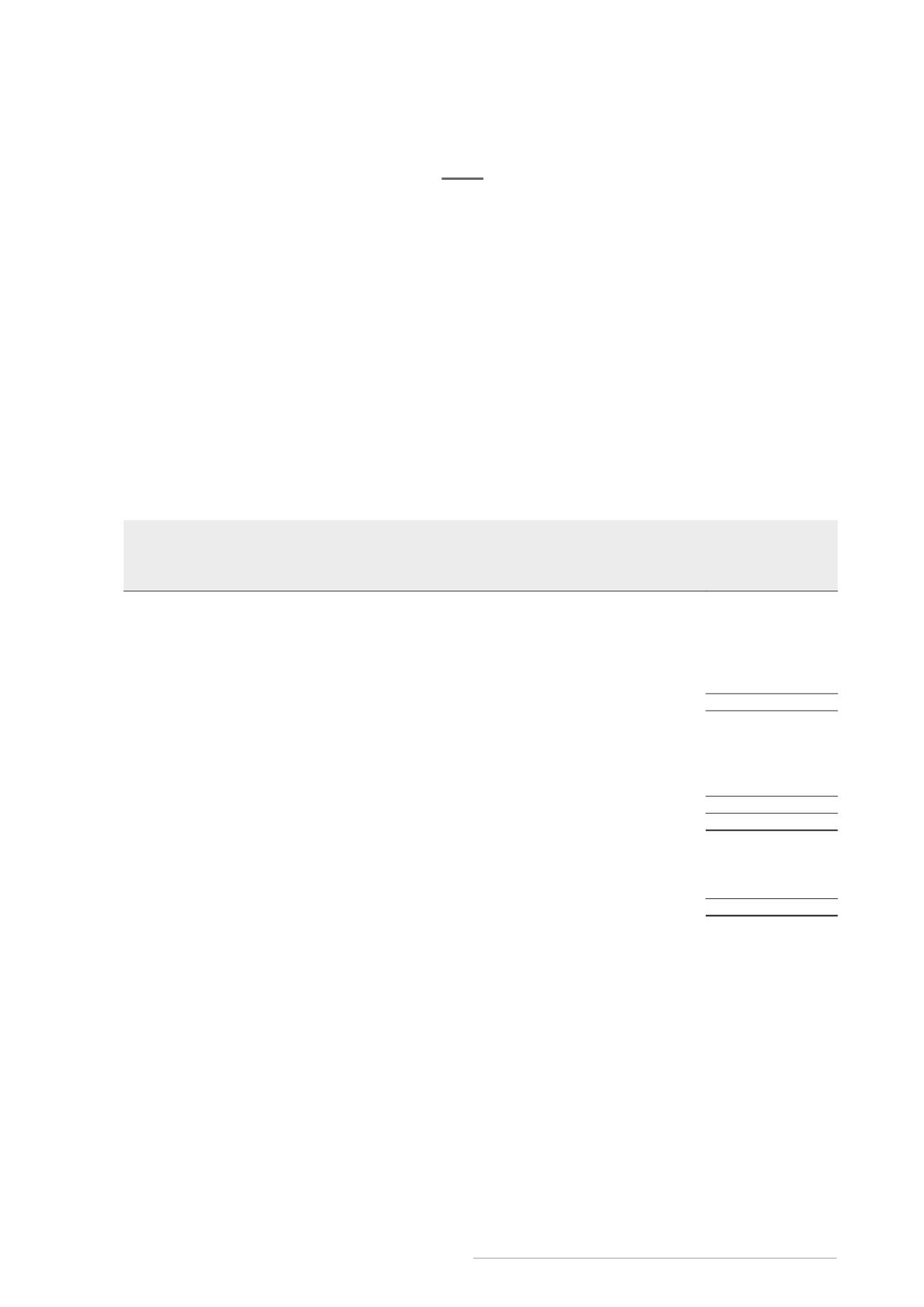

The cash flow and net assets of the subsidiaries acquired are provided below:

Cost recognised

on acquisition

2015

S$'000

Investment properties (Note 14)

448,676

Investment properties under development (Note 15)

50,693

Trade and other receivables

259,088

Cash and cash equivalents

50,895

Deferred income tax assets – net (Note 19)

1,947

811,299

Trade and other payables

(230,729)

Current income tax payable

(2,395)

Government grants

(788)

Borrowings

(274,790)

Total liabilities

(508,702)

Total identifiable net assets

302,597

Consideration transferred for acquisition:

Purchase consideration

302,597

Less: Exchange gain – unrealised

(3,172)

Purchase consideration due to Sponsor

299,425