103

EC World Real Estate Investment Trust ANNUAL REPORT 2016

NOTES TO THE

Financial Statements

For the Financial Year ended 31 December 2016

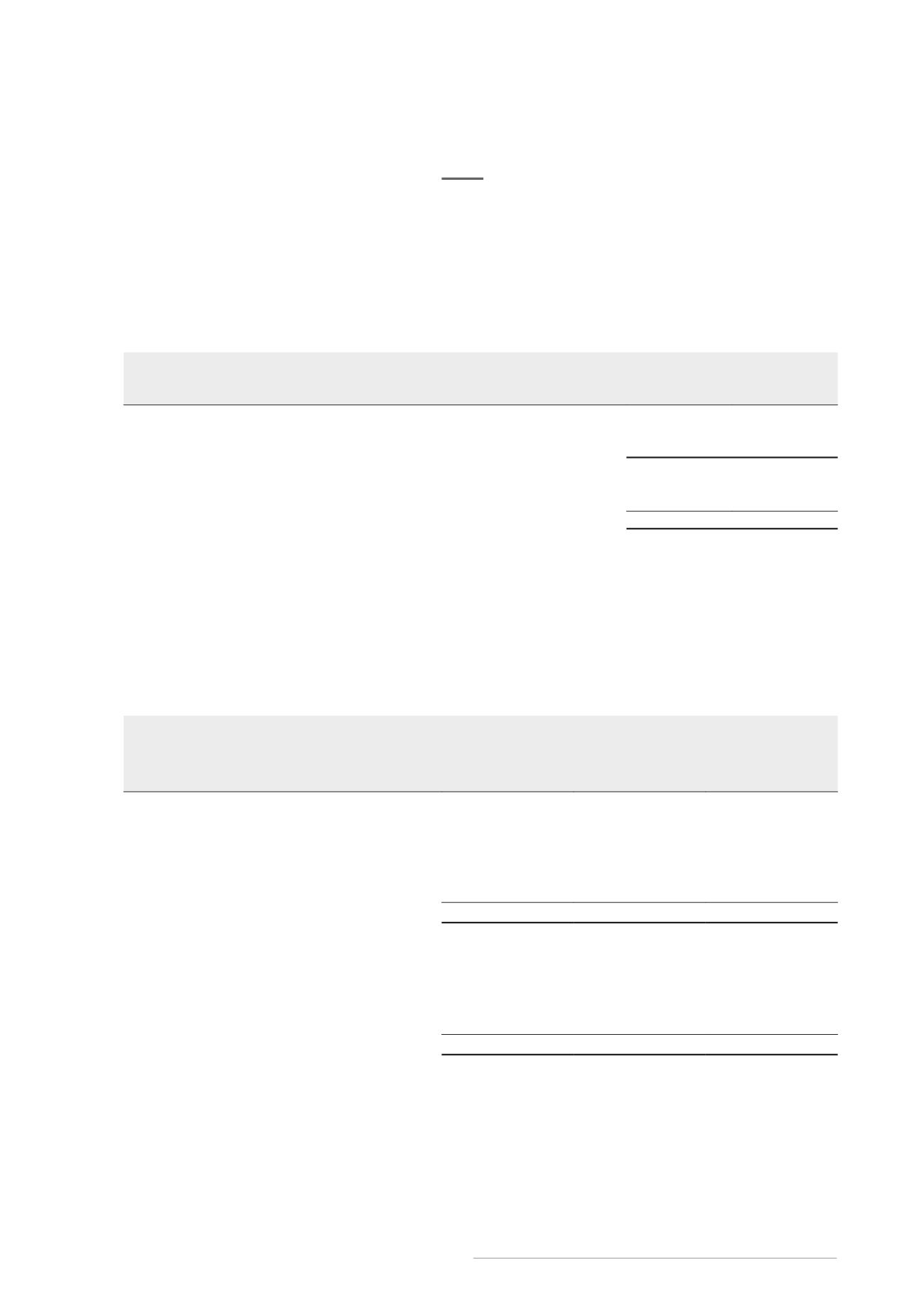

19. Deferred income tax

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current

income tax assets against current income tax liabilities and when the deferred income taxes relate to the same

fiscal authority. The amounts, determined after appropriate offsetting, are shown on the Statements of Financial

Position as follows:

Group

2016

2015

S$’000

S$’000

Deferred income tax assets

– To be recovered after 1 year

(492)

(2,000)

Deferred income tax liabilities

– To be settled after 1 year

258,900

266,595

Deferred income tax liabilities (net)

258,408

264,595

Deferred income tax liabilities of S$833,000 (2015: S$312,000) have not been recognised for the withholding

taxes and other taxes that will be payable on the earnings of its overseas subsidiaries when remitted to the holding

company as the Group is in a position to control the dividend policies of these subsidiaries and provision of such

taxes is made only when there is a plan for dividend distribution.

The movement in deferred income tax assets and liabilities (prior to offsetting of balances within the same tax

jurisdiction) is as follows:

Deferred tax liabilities

Fair value gains

on investment

properties

Accelerated

tax

depreciation

Total

S$’000

S$’000

S$’000

Group

2016

Beginning of the year

265,398

1,197

266,595

Tax charged for the year

3,129

884

4,013

Currency translation differences

(11,656)

(52)

(11,708)

End of the year

256,871

2,029

258,900

2015

Beginning of the period

–

–

–

Acquisition of subsidary

–

886

886

Tax charged for the period

269,543

367

269,910

Currency translation differences

(4,145)

(56)

(4,201)

End of the period

265,398

1,197

266,595