94

EC World Real Estate Investment Trust ANNUAL REPORT 2016

NOTES TO THE

Financial Statements

For the Financial Year ended 31 December 2016

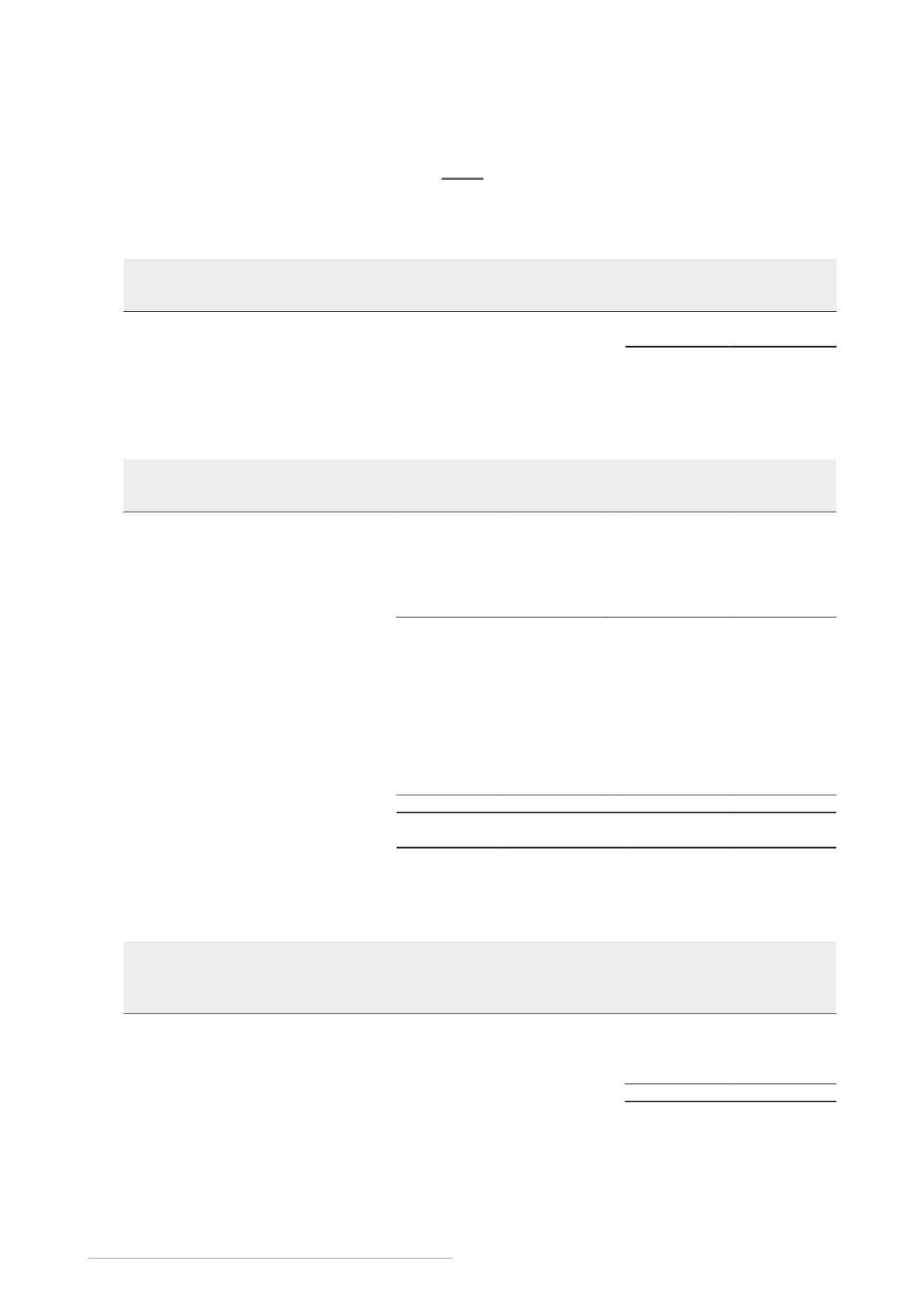

10. Financial assets, at fair value through profit or loss

Group

2016

2015

S$’000

S$’000

Structured deposits

7,700

–

During the year, the Group placed RMB37,000,000 with the financial institutions which invest in debt securities. The

principal is not guaranteed but redeemable on demand with a rate of return ranging from 2% to 4% per annum.

11. Trade and other receivables

Group

ECW

2016

2015

2016

2015

S$’000

S$’000

S$’000

S$’000

Current

Trade receivables

– Non-related parties

3,315

7,977

–

–

– Related parties

29,974

21,414

–

–

Impairment losses (non-related parties)

(954)

(218)

–

–

Trade receivables (net)

32,335

29,173

–

–

Amounts due from related parties

(non-trade)

–

76,756

–

–

Amounts due from subsidiaries

(non-trade)

–

–

10

–

Interest receivables

–

378

–

–

VAT receivables

1,853

1,631

1,009

–

Other receivables

3,061

280

42

–

Loans to third parties

–

59,122

–

–

Prepayments

15

901

–

–

37,264

168,241

1,061

–

Non-current

Other receivables

–

526

–

–

The amounts due from subsidiaries and loans to third parties are unsecured, interest-free and repayable on demand.

12. Derivative financial instruments

Group and ECW

Contract

notional amount

Fair value

Asset

Liability

S$’000

$’000

S$’000

2016

Interest rate swaps

100,000

147

–

Currency options

18,000

270

(387)

417

(387)