101

EC World Real Estate Investment Trust ANNUAL REPORT 2016

NOTES TO THE

Financial Statements

For the Financial Year ended 31 December 2016

18. Borrowings (continued)

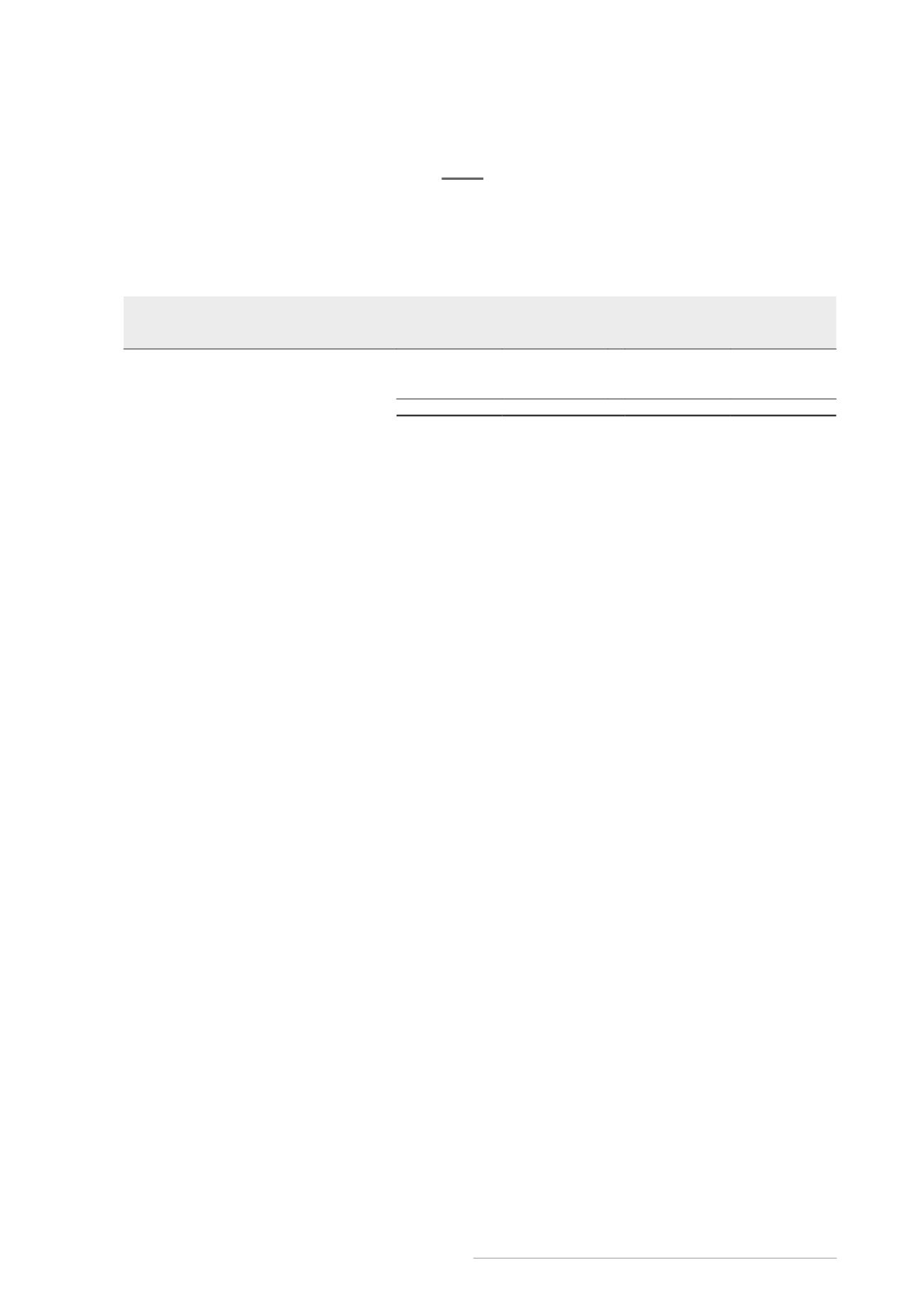

The maturity of the borrowings are as follows:

Group

ECW

2016

2015

2016

2015

S$’000

S$’000

S$’000

S$’000

Within 1 year

2,206

61,147

–

–

After 1 year but within 3 years

396,624

205,993

194,855

–

398,830

267,140

194,855

–

Measurement of fair value

The carrying amounts of Onshore and Offshore interest-bearing borrowings are repriced upon revision of

People’s Bank of China (“PBOC”) Lending Base Rate and SGD SOR, respectively. The carrying amounts of the

interest-bearing borrowings as at reporting date approximate to their corresponding fair values.

Onshore facilities

The Onshore Borrowers are the Group’s subsidiaries namely, Hangzhou Chongxian Port Investment Co., Ltd.,

Hangzhou Bei Gang Logistics Co., Ltd. and Zhejiang Hengde Sangpu Logistics Co., Ltd. (Note 16).

As at 31 December 2016, the Group has an aggregate amount of RMB1,004.2 million (equivalent to S$209 million)

term loan secured by:

i)

a first ranking pledge over the entire issued equity interest of the Group’s subsidiary, Hangzhou Chongxian

Port Logistics Co., Ltd. (Note 16);

ii)

an unconditional and irrevocable guarantee from the Onshore Guarantors on a joint and several basis,

where the “Onshore Guarantors” refer to the Group’s subsidiaries Hangzhou Fu Zhuo Industrial Co., Ltd.,

Hangzhou Fu Heng Warehouse Co., Ltd., and Hangzhou Chongxian Port Logistics Co., Ltd. (Note 16) and an

unconditional and irrevocable guarantee from DBS Trustee Limited in its capacity as the Trustee;

iii)

a first ranking mortgage over the IPO Properties;

iv)

a pledge of all sales proceeds, rental income, bond pledge and all other revenue derived from the IPO Properties;

v)

an assignment of all material agreements in relation to the IPO Properties;

vi)

an assignment of all insurance policies in relation to the IPO Properties with the onshore security agent

(being DBS Bank (China) Limited) named as the first beneficiary;