92

EC World Real Estate Investment Trust ANNUAL REPORT 2016

NOTES TO THE

Financial Statements

For the Financial Year ended 31 December 2016

6.

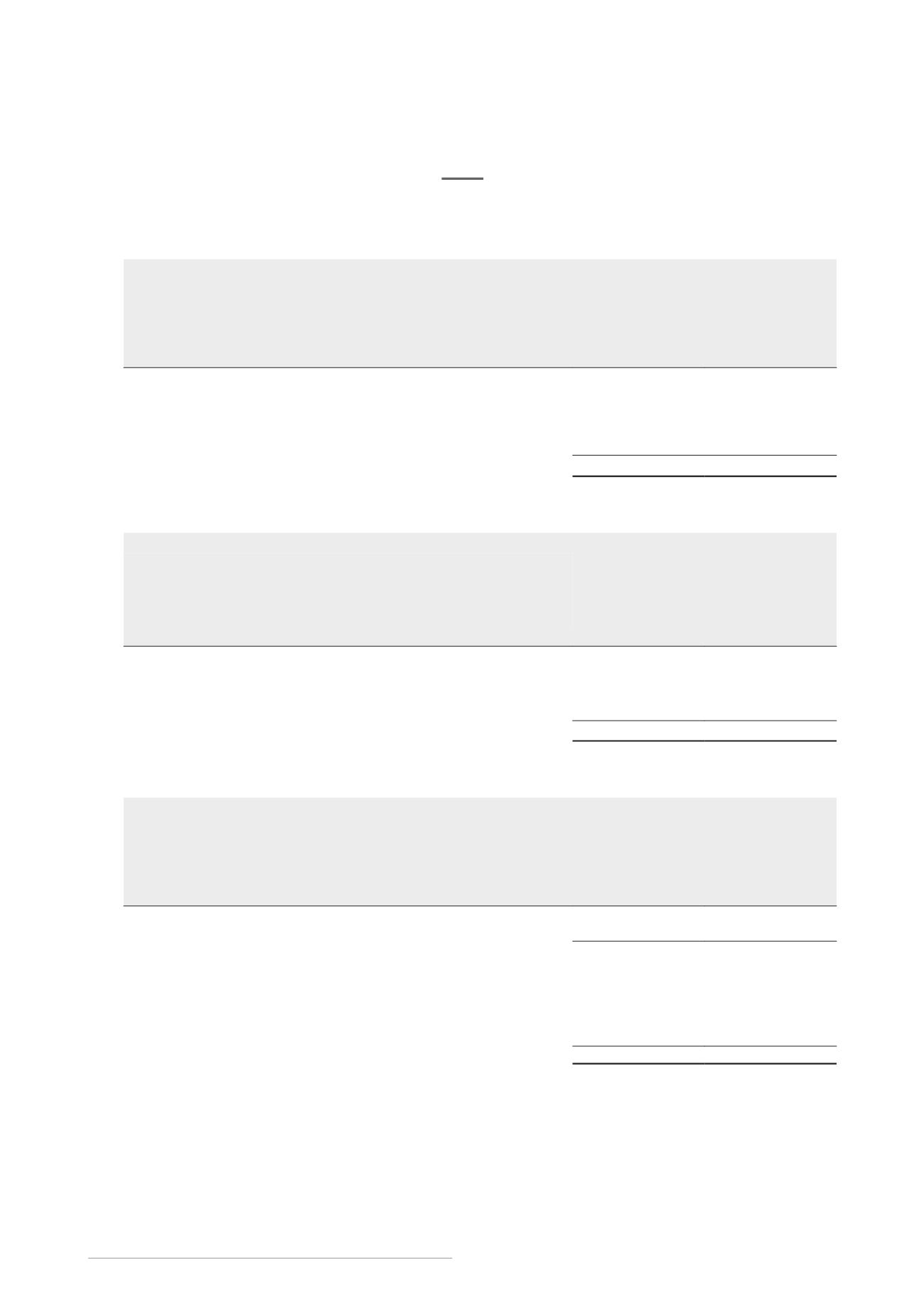

Other trust expenses

Group

Year ended

31 December

2016

Period from

5 August 2015

to 31 December

2015

SS$’000

SS$’000

Consultancy and professional fees

590

181

Valuation fees

78

–

Listing expenses

2,188

–

Others trust expenses

147

–

3,003

181

7.

Income tax expenses

Group

Year ended

31 December

2016

Period from

5 August 2015

to 31 December

2015

S$’000

S$’000

Tax expense attributable to profit is made up of:

– Current income tax

11,613

2,168

– Deferred income tax (Note 19)

5,412

270,732

17,025

272,900

The income tax expense on the results for the financial year differs from the amount that would arise using the

Singapore standard rate of income tax due to the following:

Group

Year ended

31 December

2016

Period from

5 August 2015

to 31 December

2015

S$’000

S$’000

Total return for the year/period before income tax

72,845

969,714

Tax calculated using Singapore tax rate of 17% (2015: 17%)

12,384

164,851

Effects of:

– Different tax rates in foreign jurisdiction

5,406

77,339

– Revaluation of investment properties

3,562

32,230

– Non-tax deductible items, net

2,299

24

– Income not subject to tax

(6,626)

(1,544)

17,025

272,900