76

EC World Real Estate Investment Trust ANNUAL REPORT 2016

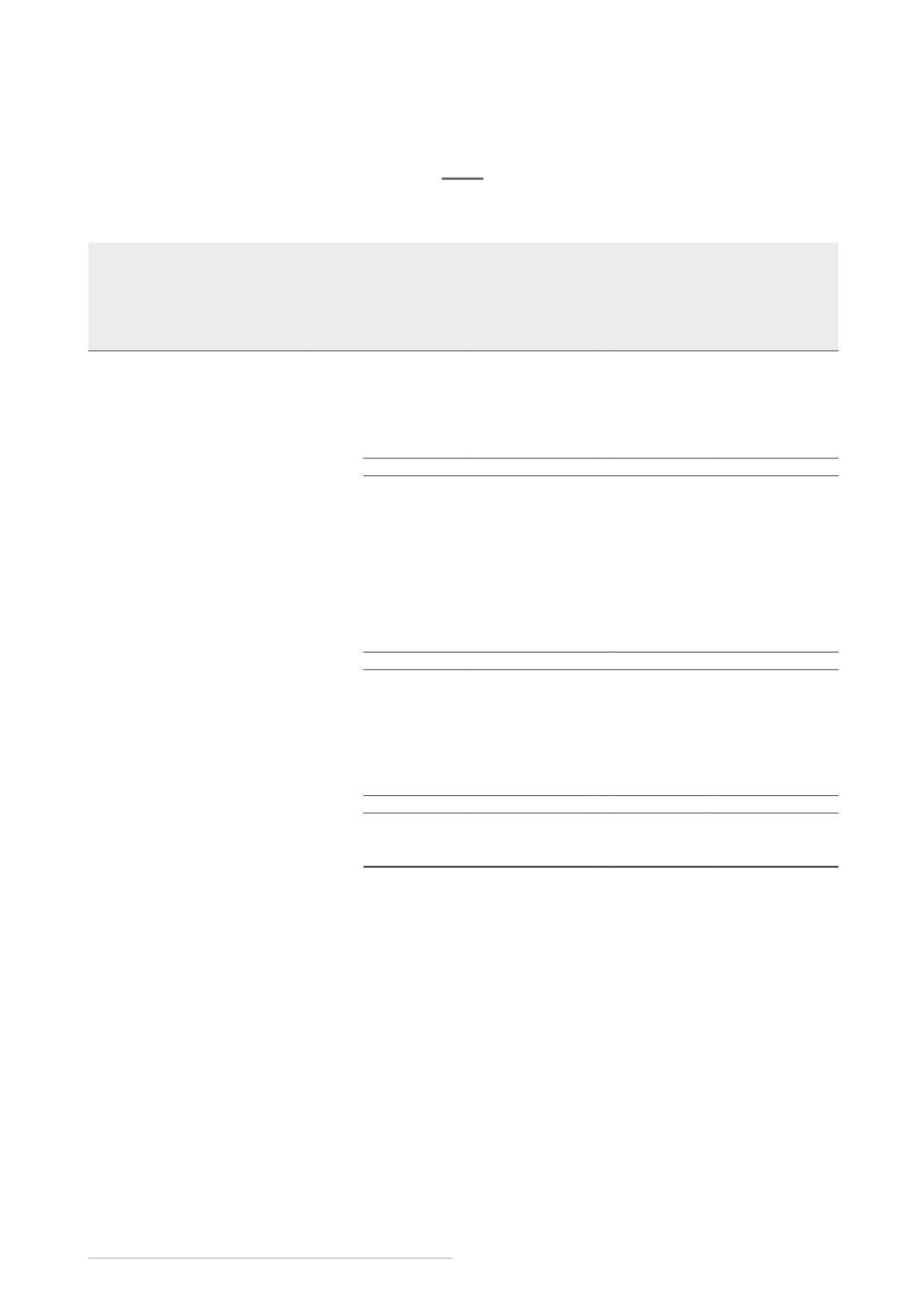

Group

ECW

Year ended

31 December

2016

#

Period from

5 August 2015

to 31 December

2015

Year ended

31 December

2016

#

Period from

5 August 2015

to 31 December

2015

Note

S$’000

S$’000

S$’000

S$’000

OPERATIONS

Beginning of the year/period

696,814

–

(167)

–

Total return for the year/period

55,820

696,814

(9,088)

(167)

Distribution to Sponsor

before listing (Note a)

(34,516)

–

–

–

End of the year/period

718,118

696,814

(9,255)

(167)

UNITHOLDERS’ CONTRIBUTION

Beginning of the year/period

–

–*

–

–*

Movement during the year/period

– Issuance of new units at listing

629,785

–

629,785

–

– Issue expenses

(12,324)

–

(12,324)

–

– Redemption of units

(545,936)

–

(545,936)

–

– Manager’s management fees

paid in units

772

–

772

–

– Distribution to Unitholders

(7,715)

–

(7,715)

–

End of the year/period

21

64,582

–*

64,582

–*

FOREIGN CURRENCY

TRANSLATION RESERVE

Beginning of the year/period

(13,944)

–

–

–

Translation differences relating to

financial statements of foreign

subsidiaries

(42,637)

(13,944)

–

–

End of the year/period

(56,581)

(13,944)

–

–

Total Unitholders’ funds at end of

the year/period

726,119

682,870

55,327

(167)

* Amounts to S$1

#

The year ended 31 December 2016 constitutes both the results when ECW was a private trust from 1 January 2016 to 27 July 2016 and after it was

listed on SGX-ST from 28 July 2016 to 31 December 2016.

Note (a): The Group holds the land use right to Bei Gang Logistics. Bei Gang Logistics comprises an entire plot of land which includes completed,

income-producing buildings being Buildings No. 1 to No. 8 (collectively, the “Stage 1 Properties”), and three plots of land under development

(comprising of Buildings No. 9 to No. 17) (collectively, the “Stage 2 Properties”). Prior to listing, the Stage 2 Properties were transferred back to

the Sponsor (FORCHN Holdings Group Co., Ltd.) as the development rights and thereafter the economic rights were assigned to the Sponsor.

As such, the assets and liabilities in relation to the Stage 2 properties amounting to S$52,536,000 and S$18,020,000 respectively were not

assumed by the Group. The aggregate net assets not assumed by the Group, amounted to S$34,516,000 and was recognised as a distribution

to the Sponsor in the consolidated financial statements for the year ended 31 December 2016.

STATEMENTS OF MOVEMENTS

IN UNITHOLDERS’ FUNDS

For the Financial Year ended 31 December 2016

The accompanying notes form an integral part of these financial statements.