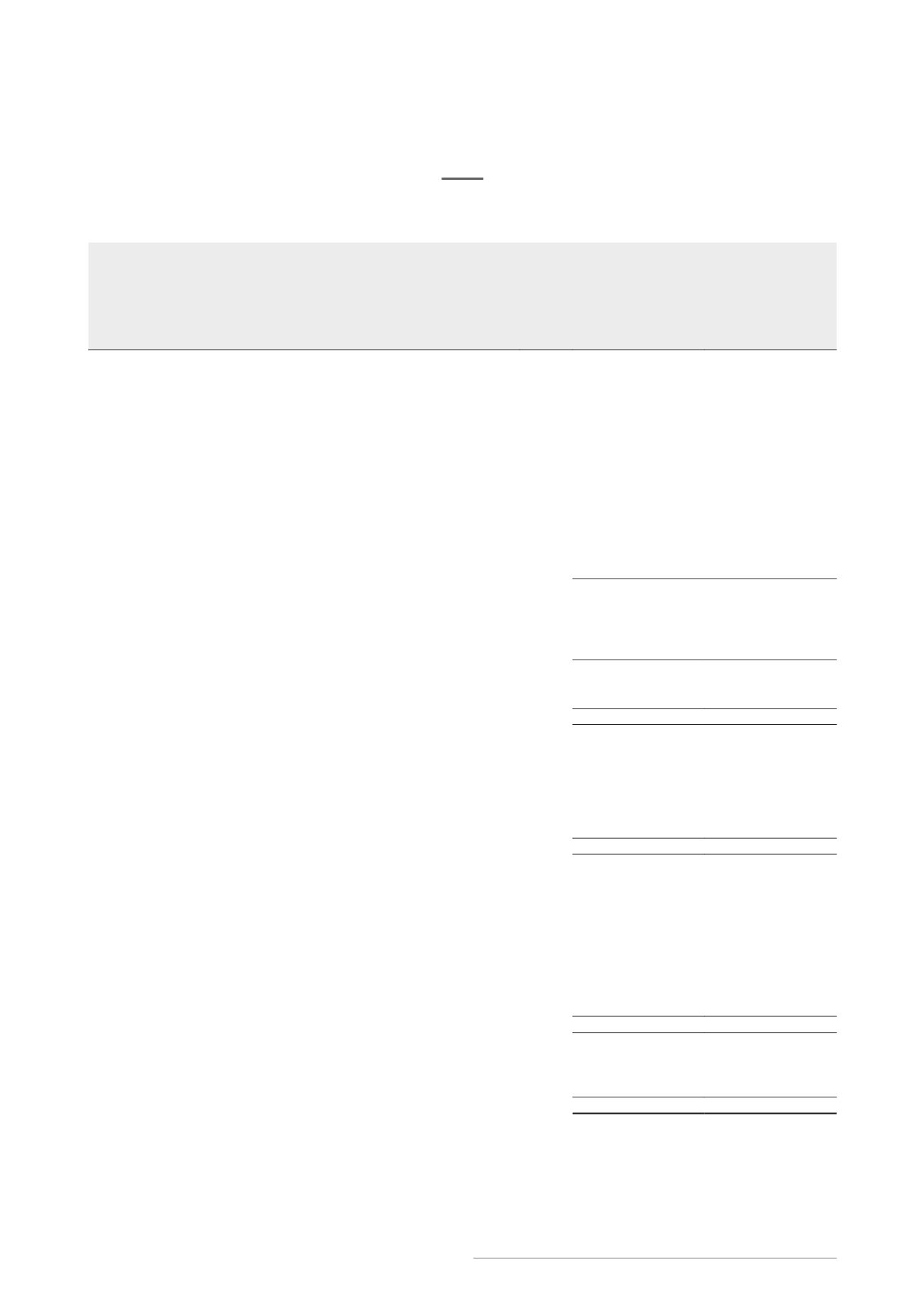

75

EC World Real Estate Investment Trust ANNUAL REPORT 2016

Group

Year ended

31 December

2016*

Period from

5 August 2015

to 31 December

2015

Note

S$’000

S$’000

Cash Flows from Operating Activities

Total return for the year/period

55,820

696,814

Adjustments for:

– Income tax expenses

7

17,025

272,900

– Finance income

(527)

(319)

– Finance cost

5

20,146

3,806

– Effect of straight lining of step-up rental

(4,436)

–

– Effect of security deposits accretion

(2,781)

–

– Fair value gain on derivative financial instruments

12

(30)

–

– Fair value loss/(gain) on investment properties

14

1,732

(949,332)

– Allowance for doubtful receivables

736

218

– Manager’s fees payable in units

1,911

–

– Exchange loss/(gain)

3,575

(3,173)

Operating cash flow before working capital change

93,171

20,914

Changes in working capital:

Trade and other receivables

80,233

86,638

Trade and other payables

(27,821)

(128,435)

Cash generated from operations

145,583

(20,883)

Interest received

882

–

Income tax paid (net)

(4,989)

(4)

Net cash provided by operating activities

141,476

(20,887)

Cash flows from Investing Activities

Additions to investment properties under construction

15

(4,462)

(4,900)

Additions to investment properties

14

(3,792)

–

Payment of purchase consideration due to Sponsor

#

16

(230,128)

–

Acquisitions of subsidiaries

16

–

50,895

Placement in structured deposits

10

(7,700)

–

Net cash outflow in investing activities

(246,082)

45,995

Cash flows from Financing Activities

Repayment of borrowings

(251,488)

(24,895)

Distribution to Unitholders

(7,715)

–

Proceeds from borrowings

392,836

19,967

Interest paid

(13,365)

(3,898)

Proceeds from new issue of shares

629,785

–

Issuance costs

(12,324)

–

Redemption of existing units

(545,936)

–

Increase in interest reserve

(9,327)

–

Net cash provided by financing activities

182,466

(8,826)

Net increase in cash and cash equivalents

77,860

16,282

Cash and cash equivalents at beginning of the year/period

16,032

–

Effects of exchange rate changes on cash and cash equivalents

446

(250)

Cash and cash equivalents at the end of the year/period

9

94,338

16,032

* The year ended 31 December 2016 constitutes both the results when ECW was a private trust from 1 January 2016 to 27 July 2016 and after it was

listed on SGX-ST from 28 July 2016 to 31 December 2016.

#

Payment of purchase consideration due to Sponsor is net of Sponsor indebtedness.

CONSOLIDATED STATEMENT

OF CASH FLOWS

For the Financial Year ended 31 December 2016

The accompanying notes form an integral part of these financial statements.