57

EC World Real Estate Investment Trust ANNUAL REPORT 2016

Enterprise Risk

Management

Risk management is an integral part of the business

of ECW and its subsidiaries (collectively, the “ECW

Group”) at both the strategic and operational levels. A

proactive approach towards risk management supports

the attainment of ECW Group’s business objective and

strategy, thereby creating and preserving value for

Unitholders.

The Manager recognises that risk management is just

as much about opportunities as it is about threats. To

capitalise on opportunities, the Manager has to take

measured risks. Therefore, risk management is not

about pursuing risk minimisation as a goal, but rather

optimising the risk-reward relationship within known

and agreed risk appetite levels. The Manager therefore

takes risks in a prudent manner for justifiable business

reasons.

The Board is responsible for the governance of risk across

ECW Group. The responsibilities include determining

ECW Group’s risk appetite, overseeing the Manager’s

Enterprise Risk Management (“ERM”) Framework,

regularly reviewing ECW Group’s risk profile, material risks

and mitigation strategies, and ensuring the effectiveness

of risk management policies and procedures. For these

purposes, it is assisted by the ARC which provides

oversight of risk management.

ECW Group’s RAS is expressed via formal, high-level

and overarching statements. Having considered key

stakeholders’ interests, ECW Group’s RAS sets out explicit,

forward-looking views of ECW Group’s desired risk profile

and is aligned to ECW Group’s strategy and business

plans. The Manager incorporates accompanying risk limits

which determine specific risk boundaries established at

an operational level.

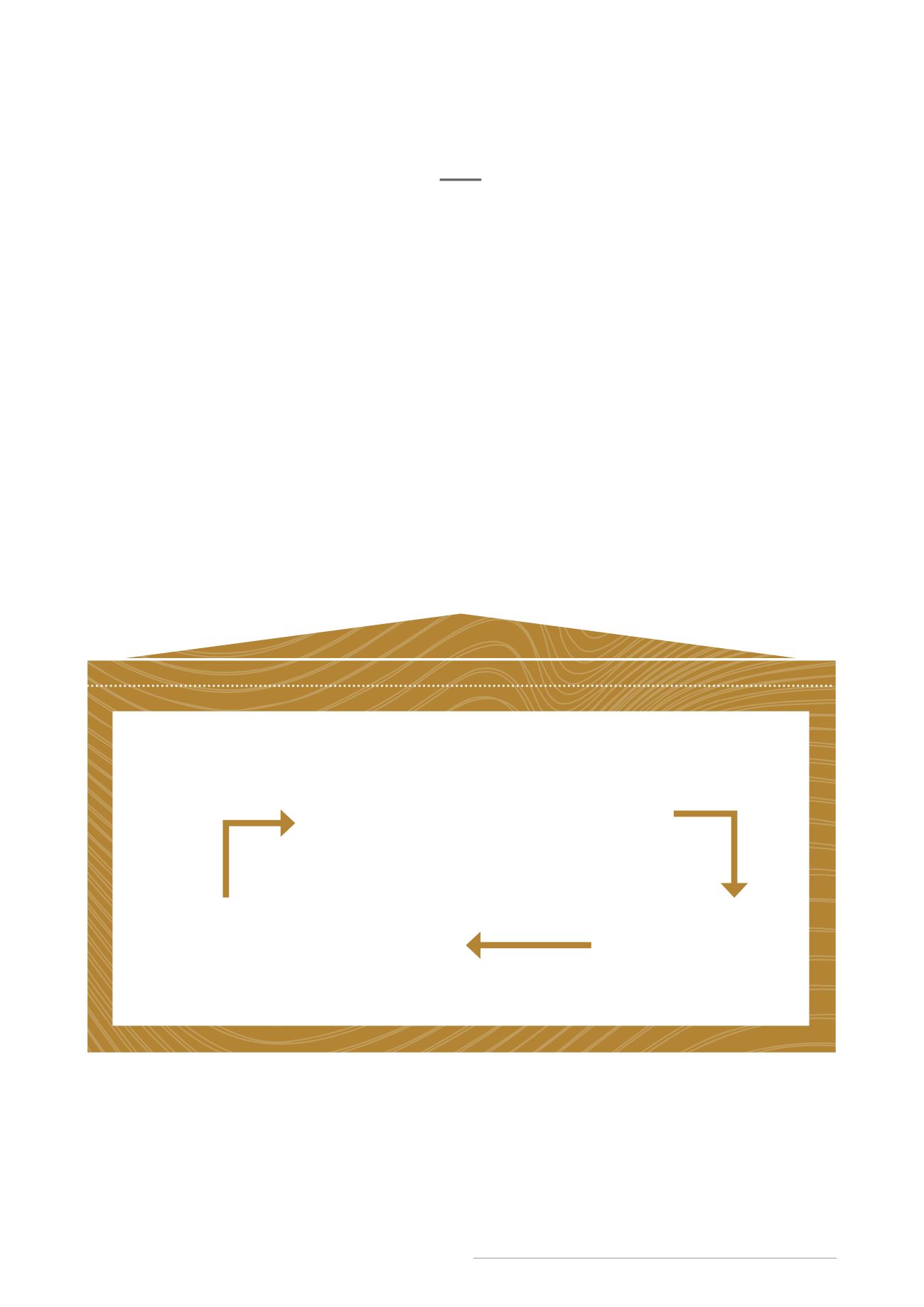

Risk Monitoring

&

Reporting

Risk

Response

Risk-Aware Culture

Board Oversight

&

Senior Management Involvement

Risk Strategy

Risk Identification

&

Assessment

• Key Risk Indicators

• Quarterly Compliance

Checklist

• Risk Appetite

• Risk

&

Control

Self-Assessment

• Investment Risk Evaluation

• Scenario Analysis

• Whistle-blowing/

Business Malpractice

• Accept

• Avoid

• Mitigate

• Transfer

Internal Control System

Independent Review

&

Audit

ERM Framework