35

EC World Real Estate Investment Trust ANNUAL REPORT 2016

Asset And Rental Growth

The Manager employs a two-pronged approach to

grow its rental income and enhance value of the REIT

portfolio. It is actively scouring the market for yield

accretive acquisitions as well as constantly evaluating

the existing portfolio for opportunities to improve it.

Acquisition

Update on properties under Right of First Refusal (ROFR)

The REIT has access to a total of 316,420 sqm of gross

floor area under ROFR.

(i)

100,777 sqm comes from Stage 2 of Bei Gang

Logistics (Buildings No. 9 to 17) and

(ii)

215,643 sqm from Fuzhou e-commerce properties.

As of 31 December 2016, construction for Buildings

No. 9 to 14 in Stage 2 of Bei Gang Logistics have been

completed and Buildings No. 9 to 12 leased out. Stage 2

of Bei Gang Logistics, which is located next to Stage 1 of

Bei Gang Logistics, provides rental space for office and

O2O retail, targeting e-commerce tenants.

Construction of Fuzhou e-commerce properties was 80%

completed as at 31 December 2016 and it is expected to

be ready for leasing in 2018.

The Manager will also proactively identify potential

acquisition targets from the Sponsor and third parties by

leveraging on the networks and business relationships of

the Sponsor.

Portfolio Management

The Manager takes a proactive approach and constantly

reviews the portfolio assets to identify Asset Enhancement

Initiatives (“AEI”) to improve portfolio returns.

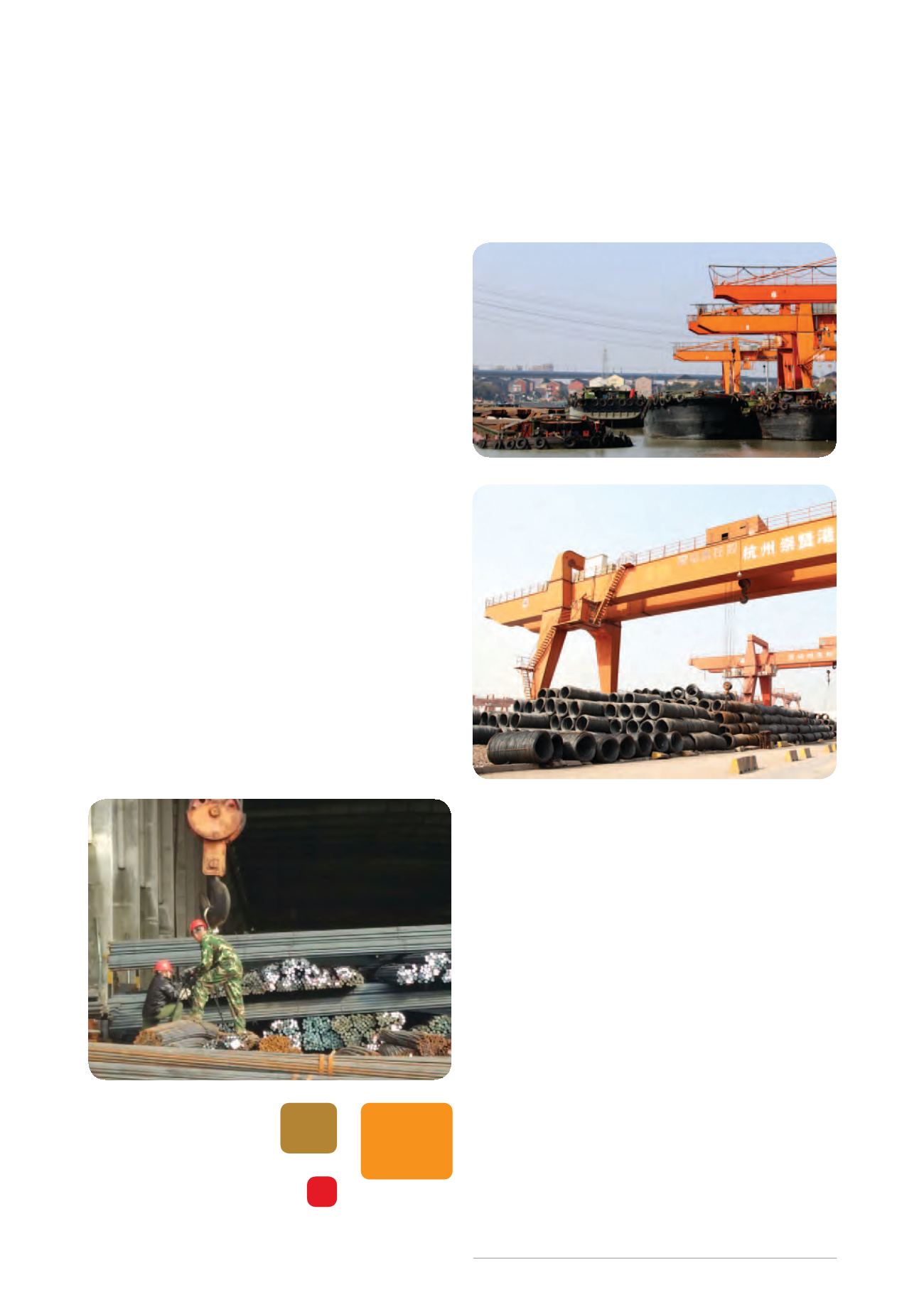

The enhancement to Chongxian Port Investment was

completed at the end of third quarter of 2016. Chongxian

Port Investment had 23 berths and 112,726 sqm of

storage yard prior to the upgrade. The upgrade converted

24,108.6 sqm of the storage yard into warehouse

space. Consequently, total income from Chongxian Port

Investment increased by 4.4% in October 2016.

LAI HOCK MENG

Executive Director and CEO