120

EC World Real Estate Investment Trust ANNUAL REPORT 2016

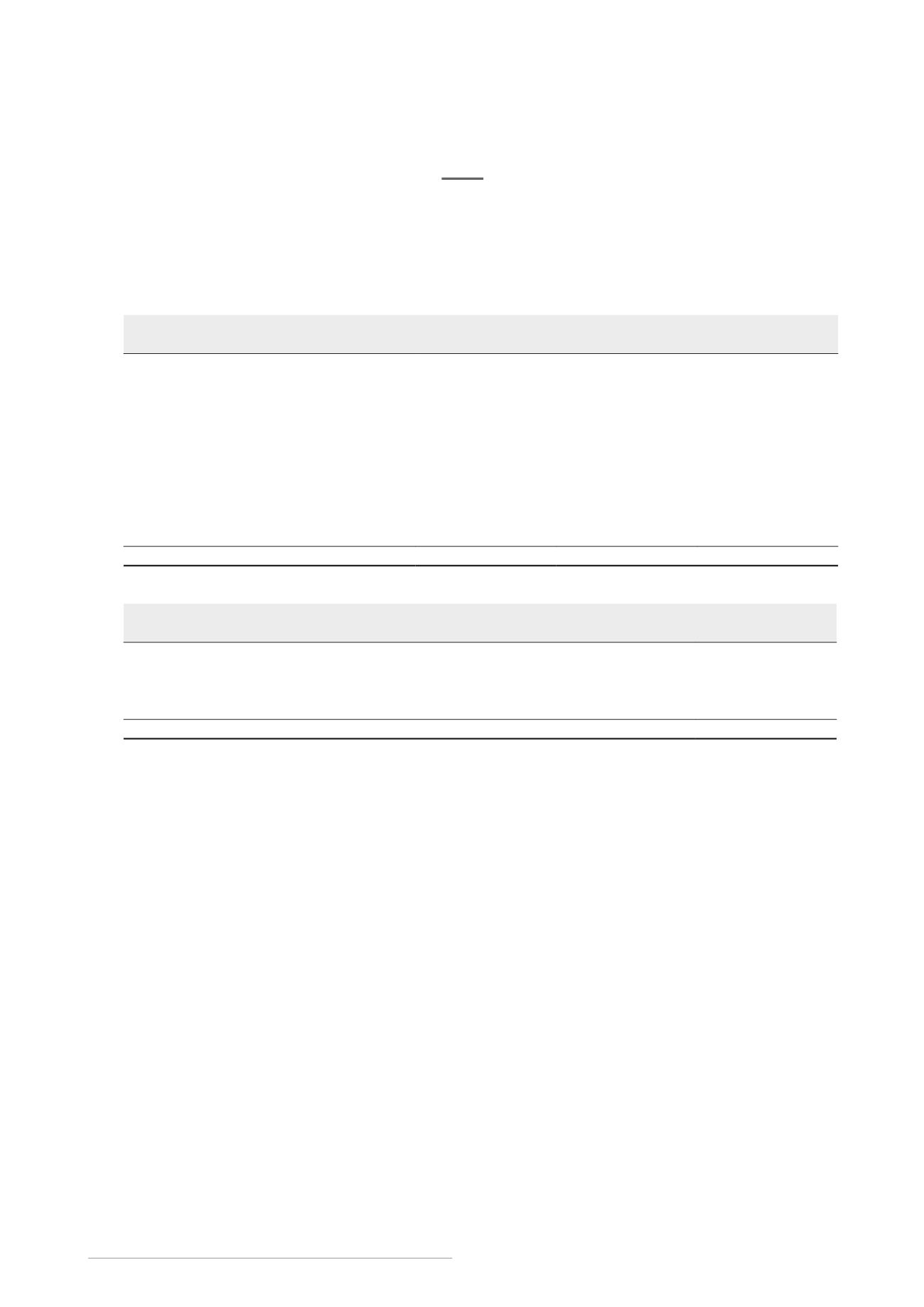

B.

UPDATE ON THE USE OF THE IPO PROCEEDS

The Manager had disclosed in the Prospectus its estimated allocation of the use of the IPO Proceeds, and the

Manager wishes to update ECW Unitholders on ECW’s utilisation of such proceeds:

Amount allocated Amount utilised

Balance

Uses

(S$’000)

(S$’000)

(S$’000)

Acquisition of PRC Property Companies

231,003

230,128

875

Repayment of existing loans

205,908

205,908

–

Redemption of units

545,936

545,936

–

Payment of initial paid-in capital

11,545

11,429

116

Transaction costs

29,597

26,595

3,002

Offshore interest reserve requirement

3,798

3,798

–

Working capital

6,060

9,628

(3.568)

Capital expenditure

1,846

1,846

–

Total

1,035,693

1,035,268

425

The breakdown on the use of IPO proceeds for the working capital is as follows:

Amount utilised

Specific uses

(S$’000)

Interest expenses

1,913

Distribution for the period from 28 July 2016 (Listing Date) to 30 September 2016

7,715

Total

9,628

The Manager will make further announcements via SGX-ST on the utilisation of the remainder of the IPO Proceeds

as and when such funds are materially disbursed.

C.

UTILISATION OF THE SECURITY DEPOSITS

The Group has received security deposits of RMB301.7 million (equivalent to S$62.8 million) from the Master

Lease tenants. As announced on 30 September 2016 and 14 October 2016, the Manager had decided to set aside

the security deposits to part-finance the potential acquisition of an asset, instead of using the security deposits

to invest in the PRC corporate bonds, after taking into account the current volatile PRC corporate bond market.

At the reporting date, there are reasonable grounds to believe that ECW and the Group will be able to repay the

security deposits at the end of the term of the Master Leases.

ADDITIONAL

INFORMATION