117

EC World Real Estate Investment Trust ANNUAL REPORT 2016

NOTES TO THE

Financial Statements

For the Financial Year ended 31 December 2016

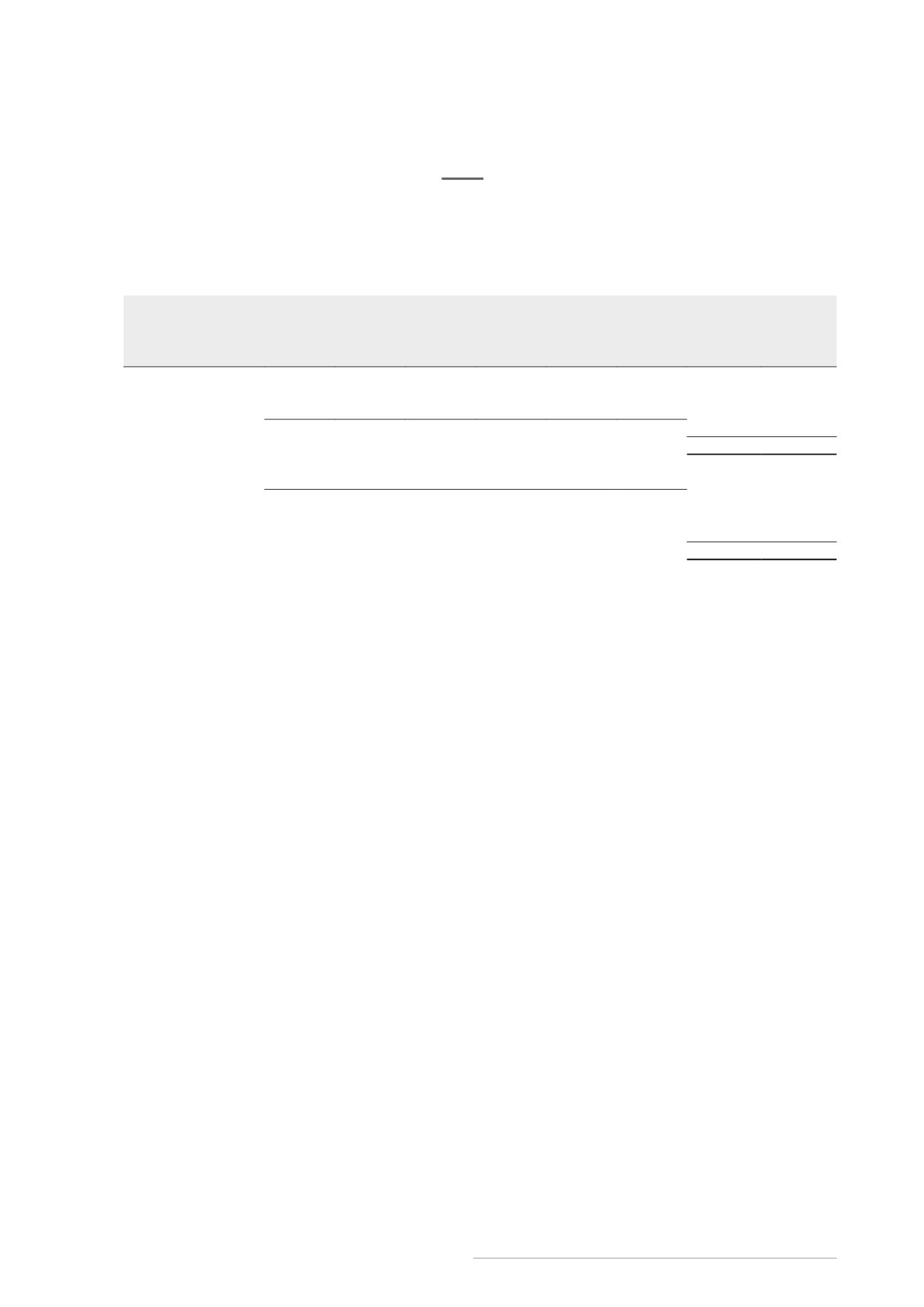

27. Segment information (continued)

Assets and liabitlites

Port

Logistics

Specialised

Logistics

E-commerce

Logistics

Total

2016

2015

2016

2015

2016

2015

2016

2015

S$’000

S$’000

S$’000

S$’000

S$’000

S$’000

S$’000

S$’000

Group

Segment assets

695,690

778,330

310,862

340,523

463,139

504,315

1,469,691

1,623,168

Unallocated assets

12,652

588

Total assets

1,482,343

1,623,756

Segment liabilities

173,366

208,037

64,359

69,083

115,122

96,940

352,847

374,060

Unallocated liabilities

– Borrowings

398,830

267,140

– Others

4,547

299,686

Total liabilities

756,224

940,886

28. New or revised accounting standards and interpretations

Below are the mandatory standards, amendments and interpretations to existing standards that have been

published, and are relevant for the Group’s accounting periods beginning on or after 1 January 2017 and which

the Group has not early adopted:

FRS 115 Revenue from contracts with customers

(effective for annual periods beginning on or after 1 January 2018)

This is the converged standard on revenue recognition. It replaces FRS 11 Construction contracts, FRS 18 Revenue,

and related interpretations. Revenue is recognised when a customer obtains control of a good or service. A

customer obtains control when it has the ability to direct the use of and obtain the benefits from the good or

service. The core principle of FRS 115 is that an entity recognises revenue to depict the transfer of promised goods

or services to customers in an amount that reflects the consideration to which the entity expects to be entitled

in exchange for those goods or services. An entity recognises revenue in accordance with that core principle by

applying the following steps:

•

Step 1: Identify the contract(s) with a customer

•

Step 2: Identify the performance obligations in the contract

•

Step 3: Determine the transaction price

•

Step 4: Allocate the transaction price to the performance obligations in the contract

•

Step 5: Recognise revenue when (or as) the entity satisfies a performance obligation

FRS 115 also includes a cohesive set of disclosure requirements that will result in an entity providing users of

financial statements with comprehensive information about the nature, amount, timing and uncertainty of

revenue and cash flows arising from the entity’s contracts with customers.

The Group is currently assessing the impact of FRS 115 and plans to adopt the new standard on the required

effective date.