110

EC World Real Estate Investment Trust ANNUAL REPORT 2016

NOTES TO THE

Financial Statements

For the Financial Year ended 31 December 2016

23. Financial risk management (continued)

(b) Credit risk

Credit risk refers to the risk that a counterparty will default on its contractual obligations resulting in financial

loss to the Group. The Group’s primary exposure to credit risk arises through its trade and other receivables.

The Group adopts the policy of dealing only with customers of appropriate credit standing and history. For

other financial assets, the Group adopts the policy of dealing only with high credit quality counterparties.

The trade receivables of the Group comprise 1 debtor (2015: 1 debtor) that represent 75% (2015: 67%) of

trade receivables. More than 90% (2015: 70%) of the Group’s trade receivables are due from related parties

which are incorporated in the PRC.

ECW does not have trade receivables balance outstanding as at 31 December 2016 and 31 December 2015.

(i)

Financial assets that are neither past due or impaired

Bank deposits that are neither past due nor impaired are mainly deposits with banks with high credit-

ratings assigned by international credit-rating agencies. Trade receivables that are neither past due nor

impaired are substantially companies with a good collection track record with the Group and Company.

(

ii)

Financial assets that are past due and/or impaired

There is no other class of financial assets that is past due and/or impaired except for trade receivables.

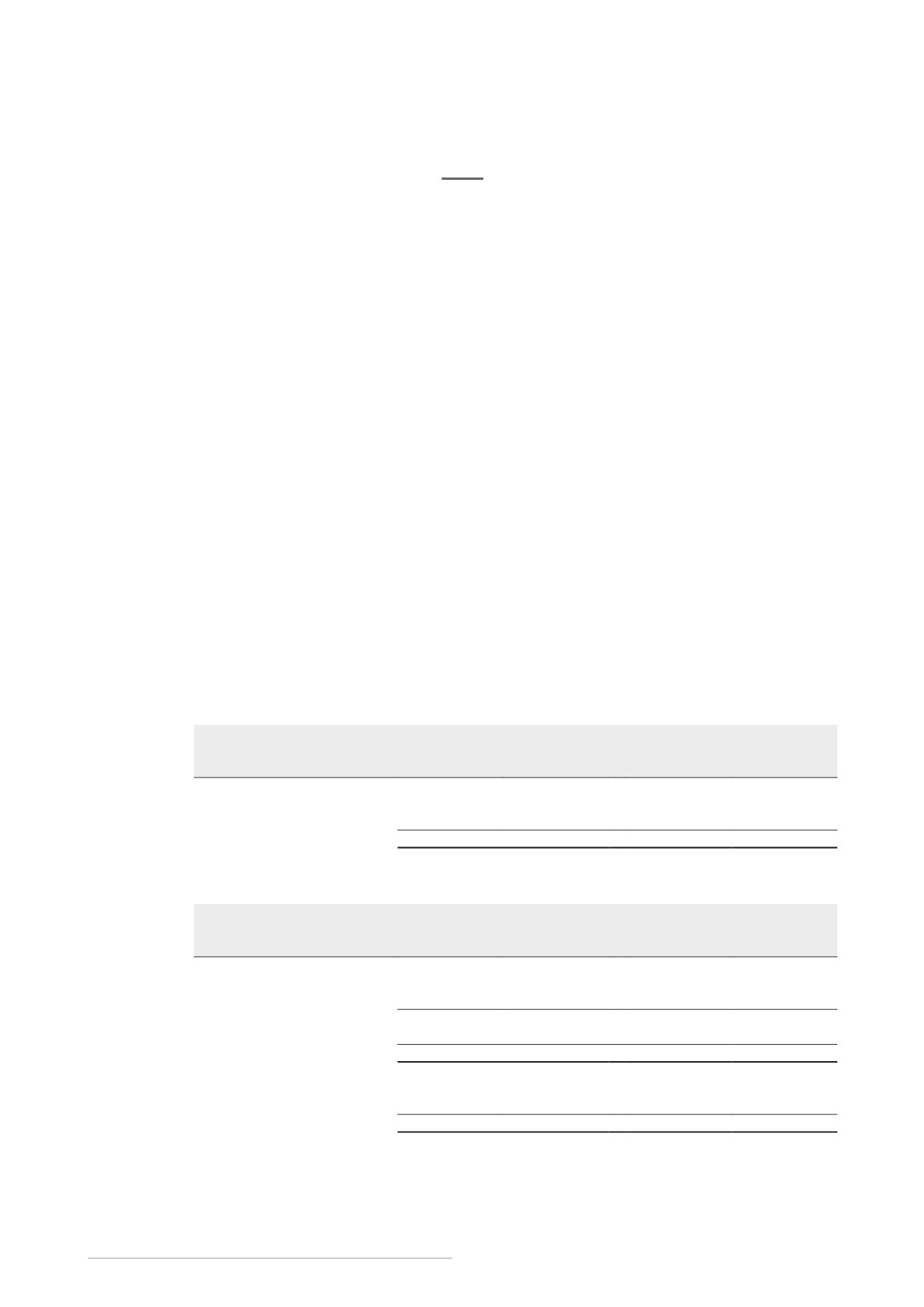

The age analysis of trade receivables past due but not impaired is as follows:

Group

ECW

2016

2015

2016

2015

S$’000

S$’000

S$’000

S$’000

Past due 0 to 3 months

317

4,731

–

–

Past due over 3 months

2,042

3,246

–

–

2,359

7,977

–

–

The carrying amount of trade receivables individually determined to be impaired and the movement in

the related allowance for impairment are as follows:

Group

ECW

2016

2015

2016

2015

S$’000

S$’000

S$’000

S$’000

Past due 0 to 3 months

317

–

–

–

Past due over 3 months

419

218

–

–

736

218

–

–

Less: Allowance for impairment

(736)

(218)

–

–

–

–

–

–

Beginning of the year/period

218

–

–

–

Allowance made

736

218

–

–

End of the year/period

954

218

–

–